The smart Trick of Paul B Insurance Insurance Agent For Medicare Huntington That Nobody is Discussing

Some Of Paul B Insurance Insurance Agent For Medicare Huntington

Table of Contents3 Easy Facts About Paul B Insurance Medicare Agency Huntington ShownGetting The Paul B Insurance Medicare Supplement Agent Huntington To WorkThe 7-Second Trick For Paul B Insurance Medicare Part D HuntingtonMore About Paul B Insurance Medicare Part D HuntingtonExamine This Report on Paul B Insurance Medicare Agent Huntington

Several Medicare Benefit plans deal additional advantages for oral care. Numerous Medicare Benefit prepares offer fringe benefits for hearing-related solutions. Yet you can buy a different Component D Medicare medication plan. It is unusual for a Medicare Advantage plan to not consist of drug coverage. You can have double protection with Original Medicare and also other insurance coverage, such as TRICARE, Medigap, veteran's advantages, employer plans, Medicaid, etc.You can have other dual insurance coverage with Medicaid or Unique Needs Strategies (SNPs).

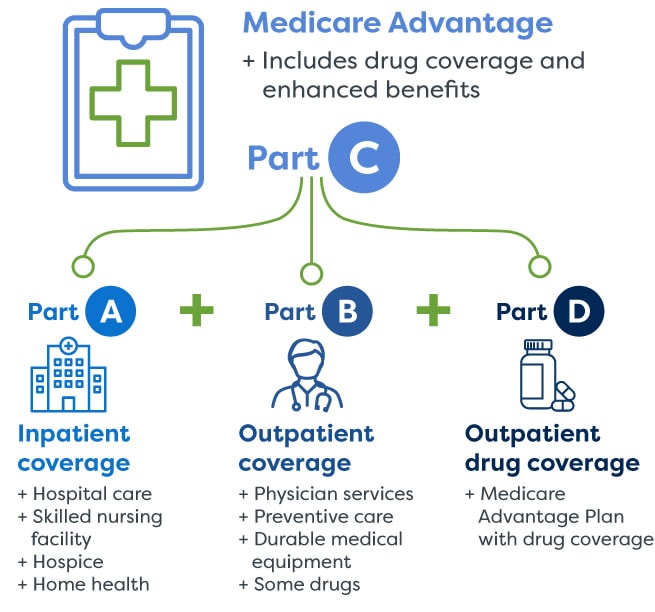

Medicare health plans provide Part A (Healthcare Facility Insurance Policy) as well as Part B (Medical Insurance) benefits to individuals with Medicare. These plans are usually used by exclusive firms that agreement with Medicare. They consist of Medicare Benefit Plans (Part C) , Medicare Cost Plans , Presentations / Pilots, and also Program of All-encompassing Take Care Of the Elderly (SPEED) .

Medicare is the government medical insurance program for individuals 65 or older, and individuals of any age with particular specials needs.

Getting The Paul B Insurance Medicare Advantage Plans Huntington To Work

Find out more in a previous blog article. These strategies are supplied by exclusive companies. They cover everything Initial Medicare does and also a lot more, occasionally consisting of added benefits that can save you money as well as help you stay healthy. There are quite a few misconceptions concerning Medicare Advantage plans. We bust these misconceptions in a previous article.

It covers some or every one of what Original Medicare does not pay, yet it does not included additionals. These strategies are supplied by personal business. paul b insurance Medicare Part D huntington. You can not sign up in both a Medicare Advantage and also Medication, Supp plan, so it is necessary to comprehend the similarities and differences between the 2. We study these in a previous blog site message.

They're vital to assume around, due to the fact that Original Medicare and Medicare Supplement Plans do not cover prescription drugs. PDP coverage is included with many Medicare Benefit Plans.

Brad as well as his wife, Meme, recognize the value of good service with good benefits. They selected UPMC for Life due to the fact that they desired the entire plan. From doctors' check outs to oral insurance coverage to our award-winning * Healthcare Attendant team, Brad as well as Meme understand look at this site they're obtaining the treatment and solutions they require with every phone call and every see.

Paul B Insurance Medicare Insurance Program Huntington - Truths

An FFS choice that allows you to see medical carriers who reduce their fees to the plan; you pay much less cash out-of-pocket when you make use of a PPO provider. When you see a PPO you typically won't need to file cases or documentation. Nevertheless, going to a PPO health center does not ensure PPO advantages for all solutions got within that healthcare facility.

Generally signing up in a FFS strategy does not guarantee long term care insurance cost that a PPO will certainly be available in your area. PPOs have a more powerful presence in some regions than others, and also in areas where there are local PPOs, the non-PPO advantage is the common benefit.

Your PCP gives your basic clinical treatment. In numerous HMOs, you need to get permission or a "reference" from your PCP to see other carriers. The reference is a referral by your medical professional for you to be evaluated and/or treated by a various medical professional or doctor. The recommendation ensures that you see the appropriate company for the care most ideal to your problem.

What Does Paul B Insurance Insurance Agent For Medicare Huntington Do?

A Health Interest-bearing accounts permits people to pay for present health and wellness expenses and conserve for future certified clinical costs on a pretax basis. Funds deposited right into an HSA are not strained, the balance in the HSA expands tax-free, and also that amount is readily available on a tax-free basis to pay medical expenses.

Medicare recipients pay absolutely nothing for most preventive services if the solutions are gotten from a medical professional or other health and wellness care company that takes part with Medicare (additionally called accepting assignment). For some preventive services, the Medicare beneficiary pays nothing for the service, however might need to pay coinsurance for the workplace visit to obtain these solutions.

The Welcome to Medicare physical test is an one-time review of your health, education and learning as well as therapy regarding precautionary services, and also recommendations for other treatment if needed. Medicare will cover this test if you get it best renters insurance within the first twelve month of enlisting partially B. You will certainly pay absolutely nothing for the test if the medical professional accepts assignment.

The Main Principles Of Paul B Insurance Insurance Agent For Medicare Huntington

On or after January 1, 2020, insurance firms are called for to offer either Plan D or G in enhancement to An and B. The MACRA modifications additionally created a new high-deductible Strategy G that might be offered starting January 1, 2020. To find out more on Medicare supplement insurance plan design/benefits, please see the Benefit Graph of Medicare Supplement Plans.

Insurance companies might not deny the applicant a Medigap policy or make any kind of costs rate differences due to health condition, declares experience, clinical problem or whether the candidate is obtaining wellness treatment solutions. Nonetheless, eligibility for plans used on a group basis is limited to those individuals who are members of the group to which the policy is provided.